In the latest measures to help buyers get on the property ladder, the government has announced adjustments to the stamp duty land tax (stamp duty) payable on completion of a purchase.

Update: This temporary measure has expired. Click here for the latest information on stamp duty.

What is stamp duty?

Stamp duty is a tax paid by the buyer and must be paid within 14 days of completing the purchase of the property. Stamp duty is paid in brackets rather than being paid as a single percentage of the total value of the property. Historically, stamp duty has been adjusted to benefit first-time buyers, but the recent changes will benefit all buyers in the market.

Want to know how stamp duty is usually calculated? Check out our stamp duty calculator.

What changes have been announced?

The government has announced that stamp duty will be suspended from July 8, 2020 to March 31, 2021. The holiday will increase the minimum threshold for stamp duty payments from the current £125,000 to £500,000.

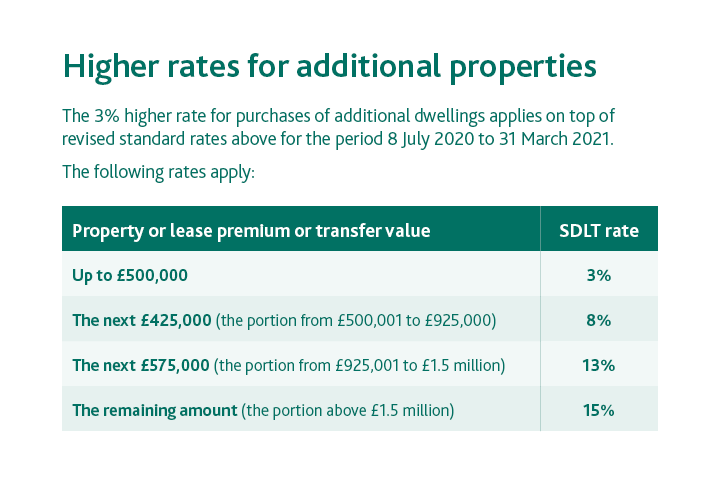

This new rate applies to all buyers, including those purchasing second homes and rental properties. You can use the stamp duty calculator here to calculate how your purchase will be affected.

Stamp duty will still be payable on properties over £500,000 and second homes or rental properties. The new stamp duty boundaries are:

What does this mean for buyers?

A new stamp duty reduction means many buyers can get their foot on the property ladder without having to factor in stamp duty costs, potentially leading to significant savings.

Here are some examples of what stamp duty could look like if the new changes are applied.

If you buy a property worth up to £500,000, you will not pay any stamp duty. If you buy a property for £750,000, you will pay 5% of the purchase price of £12,500 if it is more than £500,000 but less than £925,000. If you buy a property for £1.5 million, you will pay £78,750. This is plus 5% of the purchase price if it is over £500,000 but less than £925,000 and 8% of the purchase price if it is more than £925,000 but less than £1,500,000. 01

Even if you are considering buying a second property, you will still be paying an additional fee for the total value of the property plus stamp duty.

Calculate the stamp duty you need to pay using our stamp duty calculator.

If you're thinking of getting on the property ladder this year and want to make the most of your newly reduced stamp duty, take a look below at our beautiful property offering to suit every budget and price range.

Ivydale Road, Nunhead, SE15

£450,000 | 2 bedroom flat

Situated on the top floor of a beautiful converted red brick period building, this stunning two bedroom apartment benefits from living spaces flooded with natural light and finished to a stylish standard.

Devonshire Road, Colliers Wood, SW19

£475,000 | 2 bedroom flat

Situated on the ground floor, this lovely two-bedroom apartment is kept in excellent condition throughout and has well-proportioned accommodation, basement storage and a driveway.

Melrose Avenue, Willesden Green, NW2

£750,000 | 2 bedroom flat

A stunning period refurbishment, this stunning two double bedroom apartment features a large open plan reception room, bay facing master bedroom, landscaped gardens and off street parking.

Wren Avenue, Gladstone Park, NW2

£1.5m | 4 bedroom home

Located just steps from Gladstone Park, this beautiful four-bedroom semi-detached home boasts stylish open-plan interiors, with a substantial private garden and a fully-equipped study.

Click here to start your property search now.