Tembo has raised £14m in a Series B funding round, and the savings and mortgage platform will use the funds to enhance its services.

The company says it will use the cash to expand its savings app and launch new product lines.

It added that it would “further strengthen” its mortgage offer and “introduce new schemes to support affordability for a wider range of customers”.

The funding round was led by Goodwater Capital, with participation from the platform's existing investors including Aviva, Ascension Ventures, Love Ventures, and the McPike family office. This brings the total amount of funding raised by the company to £20 million.

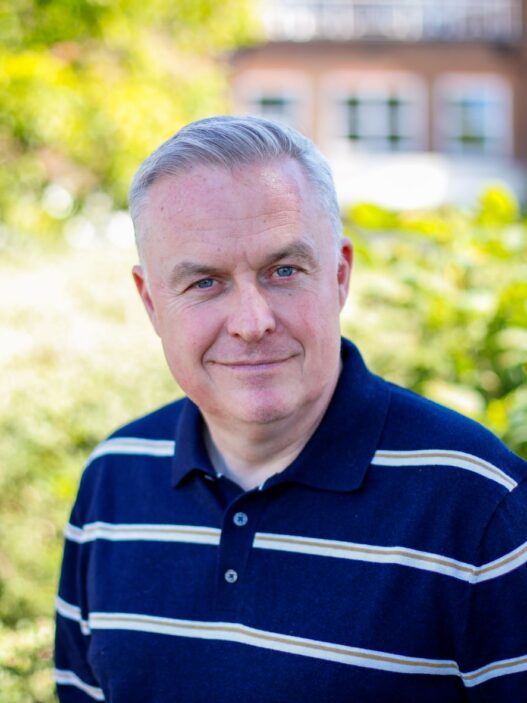

The business was co-founded in 2020 by Richard Dana, Eddie Ross and Geoff Wright and employs 85 staff.

The company has access to over 100 lenders and 10,000 mortgage products, as well as 25 bespoke schemes, including specialist income and savings boost family mortgages.

Tembo chief executive Richard Dana said the move “allows us to rapidly expand our savings platform and introduce competitive products that enable customers to save and invest more while building up their savings.” It will become so.”

Edward Robinson, a partner at Goodwater Capital, said the platform's “cutting-edge technology with customer-focused solutions” has helped the company reach “thousands of first-time buyers in ways that once seemed impossible.” “We were able to grow rapidly and achieve new things,” he added.