Stamp duty land tax reductions will be announced on Friday 23 September with immediate effect. Here's what this means for London home buyers.

P.S.: This tax reduction is no longer permanent. If you wish to use it, you must complete the purchase of the property by March 31, 2025.

Stamp duty is a land tax levied on housing. Prime Minister Liz Truss and Finance Minister Kwasi Kwarteng announced plans to cut stamp duty earlier in the week, which were approved today (Friday 23 September) in the government's mini-budget aimed at economic growth.

This tax relief will save UK-resident home buyers up to £2,500 and first-time buyers up to £11,250, opening up many new opportunities in the London property market. “The steps we have taken today mean that in total 200,000 more people will be exempt from paying stamp duty,” Prime Minister Kwarteng said.

How much will stamp duty be reduced?

Prior to the announcement, UK residents would pay stamp duty on a property starting at £125,000 and increasing as the value increased. According to the government's stamp duty reference page:

Property Value Old Stamp Duty Land Rate New Stamp Duty Land Rate Up to £125,000 0% 0% Next 125,000 (on the part between £125,001 and £250,000) 2% 0% Next £675,000 (on the part between £250,001 and £250,000 (part) £925,000) 5% 5% Next £575,000 (part from £925,001 to £1.5m) 10% 10% Remaining amount (part above £1.5m) 12% 12%

Prime Minister Kwarteng announced that the stamp duty zero rate range has been permanently increased. This doubles the price you can buy a property without paying stamp duty to £250,000, saving you up to £2,500. These stamp duty savings could help you invest in a larger property, a house with a backyard, or a more optimal location.

More benefits for first-time buyers

Band fees for first-time buyers have also increased. Previously, first-time buyers paid 0% stamp duty on the value of their property up to £300,000. The new announcement brings its zero rate band up to £425,000. Additionally, first-time buyers can now claim property value relief of up to £625,000, whereas previously they could claim property value relief of up to £500,000. Once these new rules are introduced, first-time buyers will be able to save up to £11,250. This price range allows for a great first home opportunity.

This also coincides with the last stage of Help To Buy. First-time buyers who wish to take advantage of this scheme must submit their application by October 31, 2022. So if you want to take advantage of both the new stamp duty, it's important to get in touch as soon as possible for rules and purchase help.

Impact on Londoners

To put this stamp duty cut into perspective, there was a stamp duty holiday from early July 2020 to the end of September 2021, which had a huge impact on the London housing market. If you buy property worth up to £125,000 before the holidays, you will no longer have to pay stamp duty. Over the holiday period, buyers didn't have to pay tax on properties worth up to £500,000, meaning they could save up to £15,000, prompting many to consider a higher range than usual.

Looking at June 2020, just before stamp duty started, and June 2020, right at the height of the holidays, the number of completed transactions across London's housing market rose by 62% in June 2021. Looking at the period from January to September 2021, there was a 57% increase in completed transactions across the London housing market compared to the same period last year, as there was a drive to complete deals before the end of the holidays.

Analytics provided by Foxtons Business Analytics

Significant savings create strong incentives and result in higher value real estate for many homebuyers. The new stamp duty reduction was proposed with a similar purpose. Londoners will be able to get better value for their homes and make smarter investments for their future.

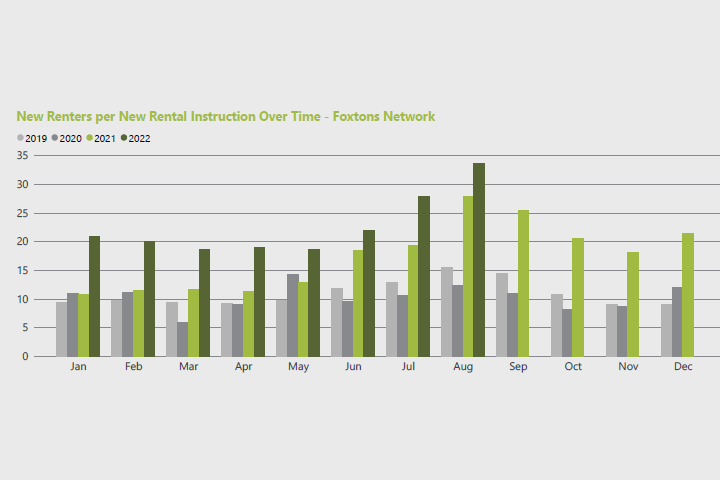

There are also benefits for London landlords who have the goal of expanding their portfolio. So far this year, new rental properties in the London market are down 39% compared to 2021. There is a significant shortage in the supply of rental properties. Our latest Rental Market Report states that “August 2022 saw the highest number of applicant registrations ever for a month.” Sarah Tonkinson, Managing Director of Institutional PRS and Build to Rent at Foxtons, said: “With new rental stock in short supply and record demand this year, rental “We're heading into a potentially unprecedented fourth quarter of demand.” Therefore, given the news of stamp duty cuts, landlords will be able to expand their portfolios and take advantage of the very high rental demand, increasing the supply of London properties for rent.

contact

If you've been waiting for the market to change, are a landlord considering portfolio opportunities, or are considering relocating, now is your chance. Get in touch and we can help you make the most of your stamp duty relief. Find your local Foxtons office here , contact us through your My Foxtons account or contact the team at Alexander Hall to answer your stamp duty questions and make the most of the changes.